5 Simple Steps to Master Your Systematic Investment Plan for Wealth Creation

Ever stared at your savings account, wondering how to make it grow without risking it all? You’re not alone. Many of us dream of financial freedom but feel lost when it comes to investing. Enter the Systematic Investment Plan (SIP)—a beginner-friendly way to build wealth steadily. Imagine planting a seed today that grows into a crore over time. Sounds exciting, right? In this guide, we’ll walk you through what a Systematic Investment Plan is, why it’s a game-changer, and how to start one without stress. Whether you’re investing ₹500 or ₹20,000 a month, you’ll get clear, actionable steps to kickstart your journey. Let’s turn your financial dreams into reality!

What is a Systematic Investment Plan?

A Systematic Investment Plan, or SIP, is a method of investing a fixed amount regularly—think monthly—into mutual funds, often index funds tracking markets like the Nifty 50. It’s like setting up a recurring payment for your future wealth, letting you buy units of a fund over time. I remember when I first heard about SIPs; it felt like subscribing to a gym membership for my money—small, consistent efforts leading to big results! By spreading investments across months, you reduce the risk of market ups and downs, making it perfect for beginners. With SIPs, you don’t need to be a stock market guru—just disciplined.

Why Should You Care About a Systematic Investment Plan?

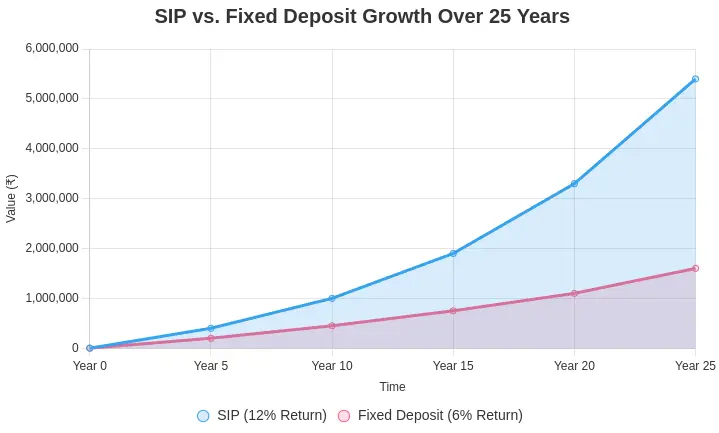

Why should SIPs matter to you? Because not investing is riskier than starting small. Picture Arjun, a 28-year-old IT professional in Bengaluru, who kept his savings in a bank, earning a measly 3% interest. Over 25 years, he missed out on becoming a crorepati by not starting a ₹5,000 monthly SIP in a Nifty 50 fund, which could’ve grown at 12-14% annually. SIPs let you harness the power of compounding and market growth, even with modest sums. In my experience, they’re a low-stress way to build wealth while you focus on life—whether it’s your career or family. Ready to secure your future?

5 Key Benefits of a Systematic Investment Plan

SIPs are more than just a buzzword. Here are five reasons they’re a smart choice for beginners:

1. Affordable Entry Point

You can start an SIP with as little as ₹500 a month—less than your coffee budget! This makes investing accessible, no matter your income.

2. Rupee Cost Averaging

SIPs spread your investment over time, buying more units when prices are low and fewer when high. It’s like shopping smarter during sales, reducing market timing risks.

3. Power of Compounding

Your money grows exponentially as returns earn more returns. A visual here, like a graph showing ₹5,000 monthly SIP growth over 25 years, would drive this home.

4. Flexibility

Choose your investment amount and date—say, the 5th of every month. No lock-in period means you can pause or adjust as needed.

5. Passive Investing

SIPs in index funds (like Nifty 50) require minimal effort. They track the market, offering steady returns with low fees, perfect for hands-off wealth-building.

Which benefit excites you most? Share in the comments!

How to Start a Systematic Investment Plan

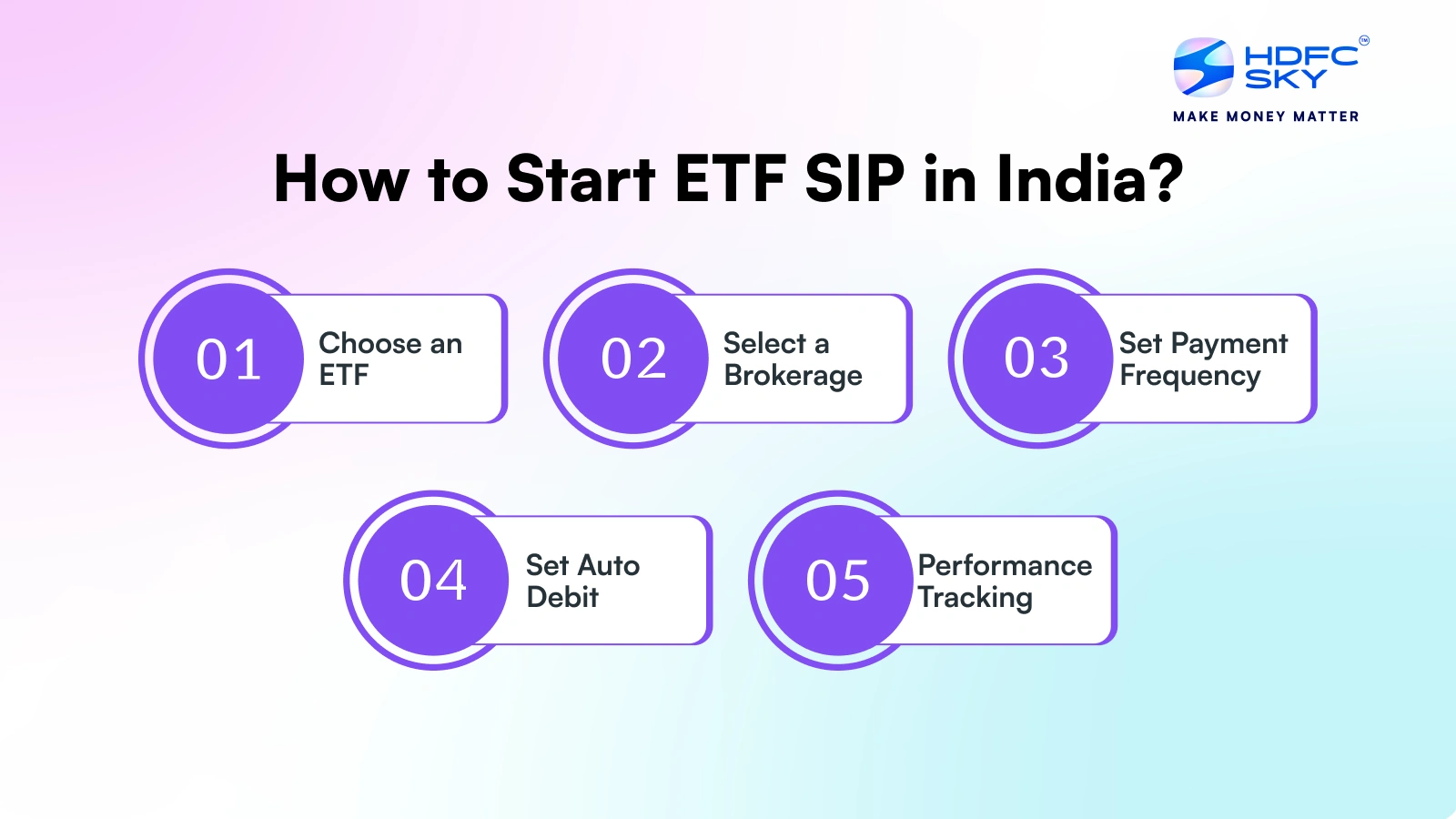

Ready to dive in? Follow these five actionable steps to launch your SIP:

- Open a Demat Account: Sign up with a trusted platform (links often available on financial sites). It’s your gateway to mutual funds.

- Navigate to Mutual Funds: Log into your Demat account, find the “Mutual Funds” section, and select “SIP” to start.

- Choose a Fund: Opt for a low-cost index fund, like UTI Nifty 50 (0.18% expense ratio). Check returns, expense ratio, tracking error, and fund size.

- Set Amount and Date: Pick an amount (e.g., ₹2,000/month) and a date (e.g., 5th). Confirm no lock-in period for flexibility.

- Pay and Track: Use UPI or net banking for your first instalment. Monitor your portfolio in the app to watch your wealth grow.

Start with ₹500 this month and see how it feels!

Common Mistakes to Avoid with a Systematic Investment Plan

We’ve all been tempted to take shortcuts, but here’s what to steer clear of:

- Chasing High Returns Only: Focusing solely on past returns ignores fees or tracking errors. Always check expense ratios (e.g., 0.18% vs. 0.2%) for better long-term gains.

- Not Researching Funds: Picking a fund without checking its size or performance is like buying a car without a test drive. Research to ensure it fits your goals.

- Stopping SIPs in Market Dips: Panic-selling during market lows kills rupee cost averaging. Stay disciplined for the best results.

Final Thoughts + Call to Action

A Systematic Investment Plan is your ticket to steady wealth creation—affordable, flexible, and powerful. Like planting a tree, small, consistent investments today can shade your future with financial security. Whether it’s ₹500 or ₹5,000 a month, the key is starting now and staying consistent. Why wait to be the next crorepati? Open a Demat account, pick a low-cost index fund, and launch your SIP this week. What’s your first step going to be? Drop it in the comments—I’d love to cheer you on! Let’s make your money work harder.

https://investor.sebi.gov.in/elss.html

Blog by Santu Das

Personal Finance Educator | Simplifying Money for Everyday Lives