Bitcoin, often described as digital gold, has garnered immense attention since its inception over a decade ago. As the first decentralized cryptocurrency, Bitcoin has transformed how we think about money, value, and financial sovereignty. This blog will delve deep into Bitcoin’s origins, technology, challenges, and its potential to reshape the global financial landscape.

1. The Origins of Bitcoin

In 2008, an individual or group using the pseudonym Satoshi Nakamoto published a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This document introduced a novel concept: a decentralized digital currency that operates without a central authority or intermediary.

Bitcoin's key innovation was introducing a secure, transparent ledger called the blockchain, enabling trustless peer-to-peer transactions. In January 2009, the Bitcoin network was launched with the mining of the first block—the genesis block.

Since then, Bitcoin has emerged from a niche interest among cryptographers and cypherpunks to a global phenomenon, attracting investors, technologists, governments, and institutions.

2. How Bitcoin Works: The Technology Behind the Currency

Blockchain: The Heart of Bitcoin

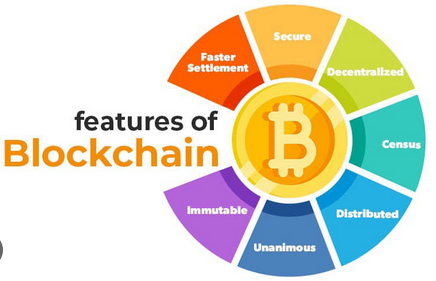

The blockchain is a distributed, immutable ledger that records all Bitcoin transactions. Instead of a centralized database, this ledger is maintained by a network of computers (nodes) spread across the globe.

Each block contains a batch of transactions, a timestamp, and a reference (hash) to the previous block, forming a chronological chain. This linkage ensures that altering any block would require redoing all subsequent blocks, making Bitcoin extremely secure.

Mining and Consensus

Bitcoin transactions need to be verified before being added to the blockchain. This validation is done by miners who compete to solve complex mathematical puzzles through a process called Proof of Work.

The miner who solves the puzzle first gets to add the next block to the chain and receives a block reward in the form of newly minted bitcoins and transaction fees. Mining ensures the network's security and regulates the issuance of bitcoin, which is capped at 21 million.

Bitcoin Wallets and Transactions

Bitcoin ownership is represented by private keys, cryptographic credentials that allow users to send bitcoins. These keys are stored in software or hardware wallets.

To send bitcoins, a user broadcasts a transaction to the network, which miners verify and record on the blockchain.

3. Key Features of Bitcoin

- Decentralization: No single entity controls the network, reducing the risk of censorship or manipulation.

- Limited Supply: Only 21 million bitcoins will ever exist, creating scarcity similar to precious metals like gold.

- Transparency: All transactions are publicly viewable, providing accountability.

- Pseudonymity: Users transact with alphanumeric addresses rather than real names, offering privacy but not complete anonymity.

- Immutability: Once confirmed, transactions cannot be reversed, eliminating fraud risks common in traditional finance.

4. The Economic and Social Impact of Bitcoin

Bitcoin challenges the traditional financial system by enabling peer-to-peer transactions without intermediaries like banks. This shift has profound implications:

Financial Inclusion

Billions of people worldwide lack access to reliable banking. Bitcoin opens access to a global, permissionless financial network, requiring only internet connectivity.

Inflation Hedge and Store of Value

With central banks printing money and rising debts, many investors turn to Bitcoin as a digital form of gold—to preserve purchasing power.

Empowerment of Individuals

Bitcoin grants users full control over their wealth without reliance on governments or banking institutions, responding to concerns about surveillance, capital controls, and financial censorship.

5. Challenges and Criticisms

While Bitcoin presents revolutionary potential, it has faced criticism and obstacles:

- Volatility: Bitcoin’s price can fluctuate wildly, posing risks for investors and limiting its use as a stable currency.

- Scalability: The network can currently handle fewer transactions compared to traditional payment systems, resulting in slower confirmation times and higher fees during peak demand.

- Environmental Concerns: Bitcoin mining consumes significant electricity, prompting debates about sustainability.

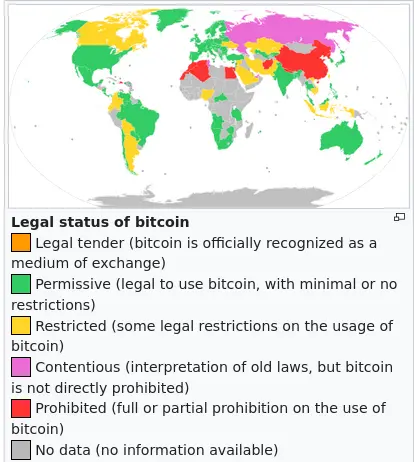

- Regulatory Risks: Governments have varied widely in their acceptance, from supportive frameworks to outright bans.

- Usability: The technology, while advancing, remains complex for many users.

6. Innovations and Future Developments

The Bitcoin ecosystem continues to evolve aggressively. Developers and entrepreneurs are addressing its limitations and expanding its use cases.

Lightning Network

A second-layer solution designed to enable fast, low-cost transactions by creating payment channels off-chain, alleviating network congestion.

Taproot Upgrade

Implemented in 2021, Taproot enhances Bitcoin privacy, scalability, and smart contract flexibility.

Institutional Adoption

Major companies, investment funds, and even some governments are increasingly embracing Bitcoin, potentially stabilizing markets and boosting legitimacy.

7. How to Buy, Store, and Use Bitcoin

Investors and users interested in Bitcoin can acquire it via cryptocurrency exchanges, peer-to-peer platforms, or Bitcoin ATMs. Secure storage options include:

- Software wallets: Apps on smartphones or desktop computers.

- Hardware wallets: Physical devices storing private keys offline.

- Custodial services: Trusted third-party providers managing keys on behalf of users.

Many merchants and service providers now accept Bitcoin as payment, expanding its utility as a medium of exchange.

8. Bitcoin Vs. Other Cryptocurrencies

Bitcoin paved the way for thousands of alternative cryptocurrencies (altcoins). While many offer novel features like smart contracts or privacy enhancements, Bitcoin remains dominant due to its first-mover advantage, security, and brand recognition.

9. The Road Ahead: Bitcoin’s Potential Impact on Finance and Society

Bitcoin represents more than just digital money — it embodies a paradigm shift in how value is exchanged and stored globally. Its decentralized nature challenges the power of centralized institutions and promises greater financial freedom.

As the world becomes increasingly digital and interconnected, Bitcoin’s role may grow, potentially becoming a global reserve asset or transforming everyday transactions.

“Bitcoin is a technological tour de force.” - Bill Gates

10. Conclusion

Bitcoin's journey over the past 15 years has been nothing short of revolutionary. From its mysterious beginnings to a multi-billion dollar asset class, Bitcoin is reshaping finance and empowering users worldwide. While challenges like volatility and regulation remain, ongoing technological improvements and growing adoption point to a promising future.

Whether viewed as an investment, a new form of money, or a political statement, Bitcoin continues to spark debate and innovation. Understanding its fundamentals, potential, and risks is vital for anyone interested in the future of money in the digital age.ng here...