What Experts Are Saying About Bitcoin’s Outlook for H2 2025

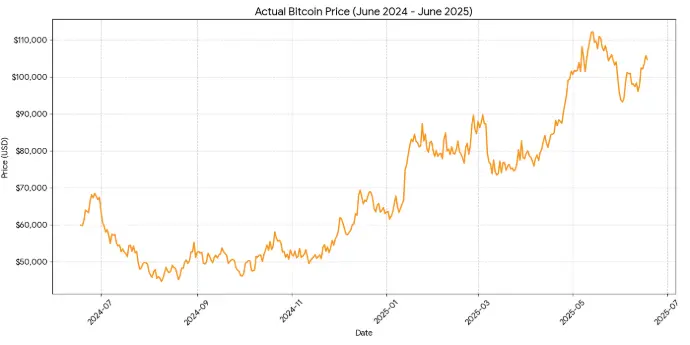

Ever felt like you’re missing the boat on Bitcoin’s wild ride? With its price soaring past $100,000 in 2024, you’re not alone in wondering where it’s headed next. For US and Indian investors, the second half of 2025 (H2 2025) promises to be a pivotal time for Bitcoin, driven by global economic shifts, regulatory changes, and growing institutional interest. But what do the experts say? Will Bitcoin skyrocket to new highs or face a sharp correction?

In this beginner-friendly guide, we’ll break down the latest expert predictions for Bitcoin’s outlook in H2 2025, why it matters for your wealth-building journey, and how you can navigate this volatile market. Whether you’re a salaried professional in Mumbai or a freelancer in New York, this post will help you understand Bitcoin’s potential. Ready to decode the future of crypto? Let’s dive in!

What Is Bitcoin’s Outlook for H2 2025?

Bitcoin’s outlook for H2 2025 refers to expert predictions and market analyses about its price and role in the financial ecosystem from July to December 2025. Experts base these forecasts on historical trends (like Bitcoin’s halving cycles), institutional adoption, regulatory shifts, and macroeconomic factors. Think of it like forecasting the monsoon—you can’t predict every raindrop, but patterns and signals give a clear picture.

Take Raj, a 30-year-old IT professional in Bengaluru. He heard about Bitcoin’s 2024 surge and invested ₹50,000 in a Bitcoin ETF via Zerodha. By mid-2025, he’s wondering if he should hold or sell. Similarly, Sarah, a 35-year-old teacher in Chicago, added Bitcoin to her 401(k) and wants to know if it’ll keep climbing. Expert outlooks help investors like Raj and Sarah make informed decisions by highlighting opportunities and risks.

Why Should You Care About Bitcoin’s Outlook?

Why does Bitcoin’s H2 2025 outlook matter to you? For US and Indian investors, Bitcoin offers a unique chance to diversify portfolios, hedge against inflation, and tap into a global asset class. In India, where savings accounts yield low returns, Bitcoin’s potential for high growth is tempting. In the US, with rising interest in crypto-friendly policies, Bitcoin is becoming a mainstream investment. Understanding expert predictions helps you time your investments and avoid costly mistakes.

Consider Arjun, a Delhi entrepreneur who invested $1,000 in Bitcoin in early 2024. By June 2025, his investment doubled, thanks to ETF inflows and pro-crypto policies. But with volatility looming, expert insights guide him on whether to cash out or hold for bigger gains. For beginners, knowing the outlook empowers you to align Bitcoin with your financial goals—be it retirement, a home, or a dream startup.

5 Key Expert Predictions for Bitcoin in H2 2025

Experts have mixed but largely bullish views on Bitcoin’s trajectory for H2 2025. Here are five key predictions, grounded in recent analyses, with insights into what drives them.

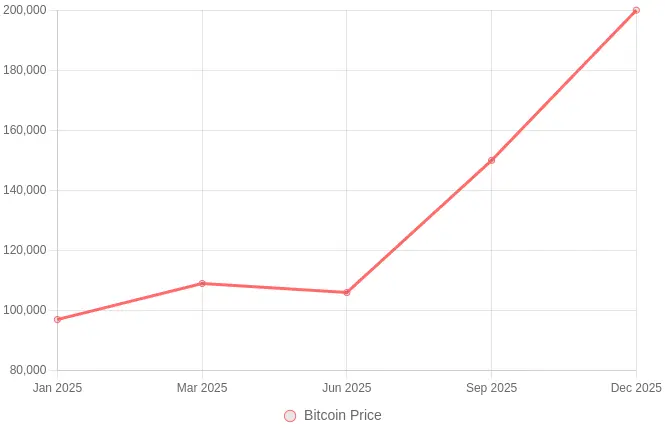

1. Bullish Surge to $150,000–$200,000

Many experts predict Bitcoin could hit $150,000–$200,000 by year-end, driven by institutional adoption and ETF inflows. Analysts like Anthony Scaramucci (SkyBridge Capital) and Tom Lee (Fundstrat Global Advisors) forecast a peak around $170,000–$200,000, citing strong demand from US spot Bitcoin ETFs and a supply crunch post the April 2024 halving.

- Why It’s Likely: BlackRock’s Bitcoin ETF hit $70 billion in assets under management (AUM), signaling robust institutional interest.

- Example: A $1,000 investment in a Bitcoin ETF at $100,000 could grow to $1,700 if Bitcoin hits $170,000.

2. Potential Correction to $70,000–$90,000

Some analysts warn of a correction, with Bitcoin possibly dropping to $70,000–$90,000 due to macroeconomic risks like US tariffs or geopolitical tensions (e.g., Israel-Iran conflict). Finder’s panel predicts an average low of $70,509, driven by profit-taking or ETF outflows.

- Why It’s Likely: Bitcoin’s volatility is legendary—past bull runs saw 70% corrections.

- Example: Raj might hold his ETF shares, knowing a dip to $80,000 could be a buying opportunity.

3. Sideways Trading Between $100,000–$130,000

Neutral forecasts suggest Bitcoin may trade sideways between $100,000 and $130,000, reflecting market indecision. Bitpanda notes mixed signals, with institutional support balanced against regulatory concerns.

4. Regulatory Boost from Pro-Crypto Policies

A Trump-led administration could drive Bitcoin higher with crypto-friendly policies, like replacing SEC Chair Gary Gensler with Paul Atkins, a crypto advocate. Experts like Cathie Wood (ARK Invest) see regulatory clarity pushing Bitcoin to $161,105 by year-end.

- Why It’s Likely: Trump’s proposed Strategic Bitcoin Reserve could reduce circulating supply, boosting prices.

- Example: Sarah’s 401(k) Bitcoin allocation could grow if US policies attract more institutional capital.

5. Long-Term Optimism Beyond 2025

Experts like Michael Saylor (MicroStrategy) and ARK Invest project Bitcoin reaching $250,000–$500,000 by 2030, but H2 2025 could set the stage with corporate adoption (e.g., 228 companies holding 820,000 BTC). Coinbase highlights rising corporate demand as a key driver.

- Why It’s Likely: Bitcoin’s halving cycles historically spark bull runs 12–18 months later, peaking in late 2025.

- Example: Arjun might hold his Bitcoin, expecting a 2030 surge to fund his startup.

Are you bullish or cautious on Bitcoin for H2 2025? Share your take in the comments!

How to Navigate Bitcoin in H2 2025: 5 Actionable Steps

Ready to act on Bitcoin’s outlook? Here’s how US and Indian beginners can invest wisely.

- Assess Your Risk Tolerance: Bitcoin’s volatility (1.94% daily swings) suits high-risk investors. Allocate only 5–10% of your portfolio.

- Choose a Platform: In the US, use Fidelity or Coinbase for ETFs; in India, try CoinDCX or WazirX for direct Bitcoin or ETFs.

- Use Dollar-Cost Averaging (DCA): Invest a fixed amount (e.g., ₹2,000 or $50 monthly) to reduce risk from price swings.

- Stay Informed: Follow trusted sources like CoinDesk or NSE for market updates. Monitor US Federal Reserve rate cuts and India’s crypto tax rules.

- Secure Your Investment: Use hardware wallets (e.g., Ledger) for direct Bitcoin holdings or trusted brokers for ETFs to protect against hacks like the 2025 Bybit breach.

Common Mistakes to Avoid with Bitcoin Investing

Bitcoin’s potential is huge, but beginners often trip up. Avoid these pitfalls.

- Chasing Hype: Buying at peaks (e.g., $110,000) due to FOMO can lead to losses. Solution: Stick to DCA and buy during dips.

- Ignoring Volatility: Expecting steady gains is unrealistic—Bitcoin dropped 4% in a day in June 2025. Solution: Plan for 20–30% swings.

- Neglecting Security: Storing Bitcoin on exchanges risks hacks. Solution: Use cold wallets or secure ETF platforms.

Final Thoughts

Bitcoin’s outlook for H2 2025 is a mix of optimism and caution. Experts see it climbing to $150,000–$200,000, driven by ETFs, corporate adoption, and pro-crypto policies, but warn of corrections to $70,000 or sideways trading. For US and Indian investors, Bitcoin offers a chance to diversify and build wealth, but only if you navigate its volatility smartly.

Take one step today: research a Bitcoin ETF (like BlackRock’s IBIT) or set up a small DCA plan on CoinDCX or Coinbase. What’s your plan for Bitcoin in 2025? Share in the comments—I’d love to hear your strategy!

Blog by Santu Das

Personal Finance Educator | Simplifying Money for Everyday Lives