Will AI Replace Financial Advisors by 2025? 5 Reasons Why It Won’t (Yet)

Picture this: It’s midnight, and you’re wondering whether to invest your bonus in a mutual fund or pay off your car loan. You open an app, and an AI-powered advisor instantly crunches your numbers, analyzes market trends, and spits out a recommendation. Sounds futuristic? It’s already here. AI tools like robo-advisors (e.g., Betterment, Wealthfront) and chatbots (e.g., ChatGPT) are transforming financial advisory, making it faster and more accessible. But can AI truly replace the human financial advisor who understands your dreams, fears, and unique life goals? By 2025, the answer is a resounding no. In this article, we’ll uncover why AI won’t replace financial advisors in the next year, how AI enhances their work, and how you can leverage both to build your wealth confidently.

What is AI in Financial Advisory?

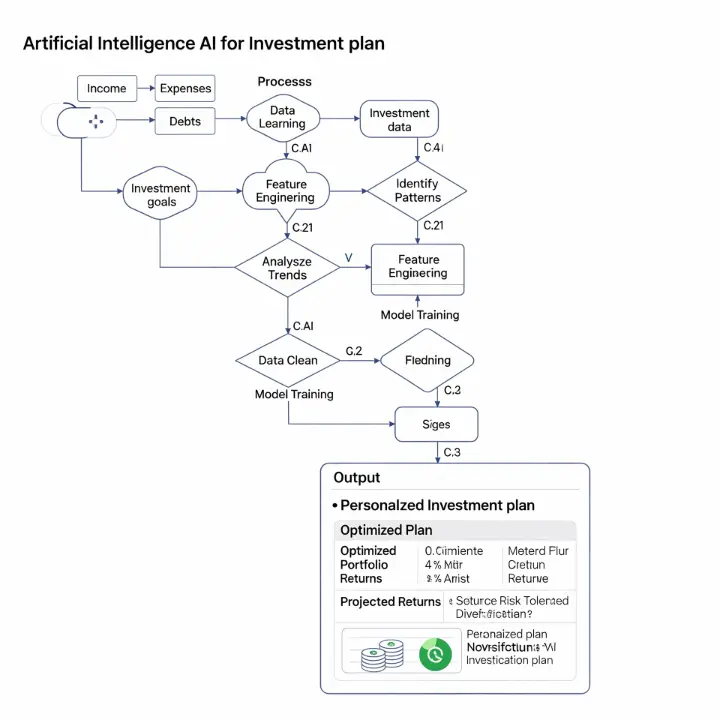

AI in financial advisory refers to the use of algorithms, machine learning, and large language models (LLMs) to provide financial guidance. These tools analyze vast datasets—your income, expenses, risk tolerance, and market trends—to deliver insights or recommendations. Think of AI as a hyper-efficient calculator with a knack for spotting patterns.

For example, imagine Raj, a 28-year-old software engineer from Mumbai. He uses a robo-advisor to invest ₹10,000 monthly in a diversified portfolio. The AI assesses his risk profile and allocates funds across stocks, bonds, and ETFs, rebalancing automatically as markets shift. It’s quick, cheap, and effective for straightforward tasks. But when Raj’s father falls ill, requiring a complex estate plan, the AI falls short—it can’t navigate emotional nuances or legal intricacies. This highlights AI’s strength (data-driven efficiency) and its Achilles’ heel (lack of human judgment).

Why Should You Care About AI in Financial Advisory?

Whether you’re saving for a home, planning retirement, or investing in stocks, AI is changing how you access financial advice. By 2025, AI-driven tools are projected to manage 10% of global assets, a staggering shift. They’re affordable, available 24/7, and democratize financial planning for people who can’t afford traditional advisors. But here’s the catch: financial decisions aren’t just about numbers—they’re deeply personal.

Take Priya, a 35-year-old entrepreneur. She used an AI budgeting app to optimize her cash flow, saving ₹15,000 monthly. But when she faced a tough call—sell her startup or reinvest profits—she turned to her human advisor. The advisor didn’t just analyze data; they understood her emotional attachment to the business and guided her through the decision. AI can’t replicate this human connection, which is why understanding its role matters to your financial future.

5 Reasons AI Won’t Replace Financial Advisors by 2025

AI’s capabilities are impressive, but human advisors remain indispensable. Here are five reasons why AI won’t take over by 2025:

1. Emotional Intelligence and Trust

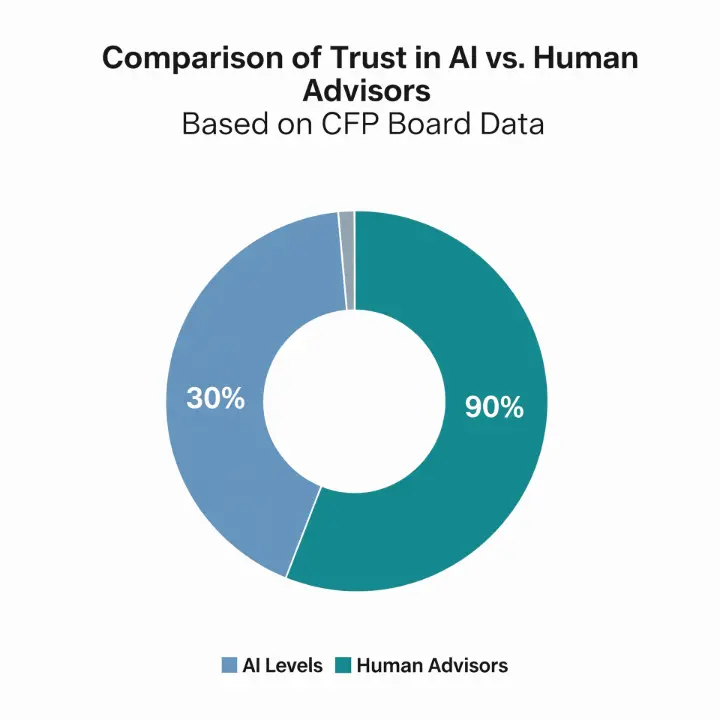

Financial decisions are emotional—whether it’s buying your first home or planning for your child’s education. Human advisors build trust through empathy, understanding your fears and aspirations. Research shows 90% of investors trust human advisors over AI, with trust in AI jumping only when vetted by humans. AI lacks the lived experience to navigate these nuances.

2. Complex, Non-Linear Planning

High-net-worth individuals or those with complex needs (e.g., estate planning, tax strategies) require nuanced advice. AI struggles with dynamic scenarios, like navigating market anomalies or personal life changes. Human advisors excel at holistic planning, considering non-liquid assets and life goals.

3. Ethical and Fiduciary Responsibility

Advisors are bound by fiduciary duty to act in your best interest, a standard AI can’t fully uphold. AI may introduce biases from training data or prioritize proprietary products, risking conflicts of interest. Human advisors navigate ethical complexities with judgment AI lacks.

4. Regulatory and Compliance Challenges

Financial advisory is heavily regulated (e.g., SEBI in India, SEC in the US). AI systems must comply with complex, region-specific rules, a hurdle that’s far from resolved by 2025. Human advisors ensure compliance while adapting to regulatory shifts.

5. The Hybrid Advantage

The future isn’t AI vs. humans—it’s collaboration. Advisors using AI (e.g., Morgan Stanley’s AI Debrief tool) enhance efficiency, analyzing data faster to focus on strategic planning. By 2025, 97% of advisors believe AI will grow their business by 20%, not replace them.

How to Leverage AI and Human Advisors Together

Want to make the most of AI and human expertise by 2025? Follow these steps:

- Use AI for Routine Tasks: Employ robo-advisors (e.g., Zerodha Coin, Groww) for low-cost portfolio management or budgeting apps (e.g., Rocket Money) to track expenses.

- Consult Humans for Complex Needs: Engage a certified financial planner (CFP) for retirement, tax, or estate planning.

- Verify AI Outputs: Cross-check AI recommendations with a human advisor to avoid “hallucinations” or errors.

- Stay Informed: Learn about AI tools through platforms like NSE India to make empowered decisions.

Are you using AI tools for your finances, or do you prefer a human advisor? Share your experience in the comments!

Are you using AI tools for your finances, or do you prefer a human advisor? Share your experience in the comments!

Common Mistakes to Avoid with AI Financial Tools

AI is powerful, but missteps can cost you. Avoid these pitfalls:

- Over-Reliance on AI: AI can hallucinate, giving confident but incorrect advice (e.g., fabricated data sources). Always verify with a human expert.

- Ignoring Emotional Context: AI lacks empathy, so don’t rely on it for emotionally charged decisions like inheritance planning.

- Neglecting Data Privacy: AI tools may log sensitive data, risking breaches. Use secure platforms and read privacy policies.

Final Thoughts

By 2025, AI will revolutionize financial advisory, making it more accessible and efficient—but it won’t replace human advisors. The human touch, ethical judgment, and ability to navigate complexity keep advisors at the helm. AI is your co-pilot, not the captain. To build wealth confidently, combine AI’s data prowess with a trusted advisor’s wisdom.

What’s your next step? Try a robo-advisor for small investments or book a consultation with a CFP to plan your future. Share your plan in the comments below!

Blog by Santu Das

Personal Finance Educator | Simplifying Money for Everyday Lives